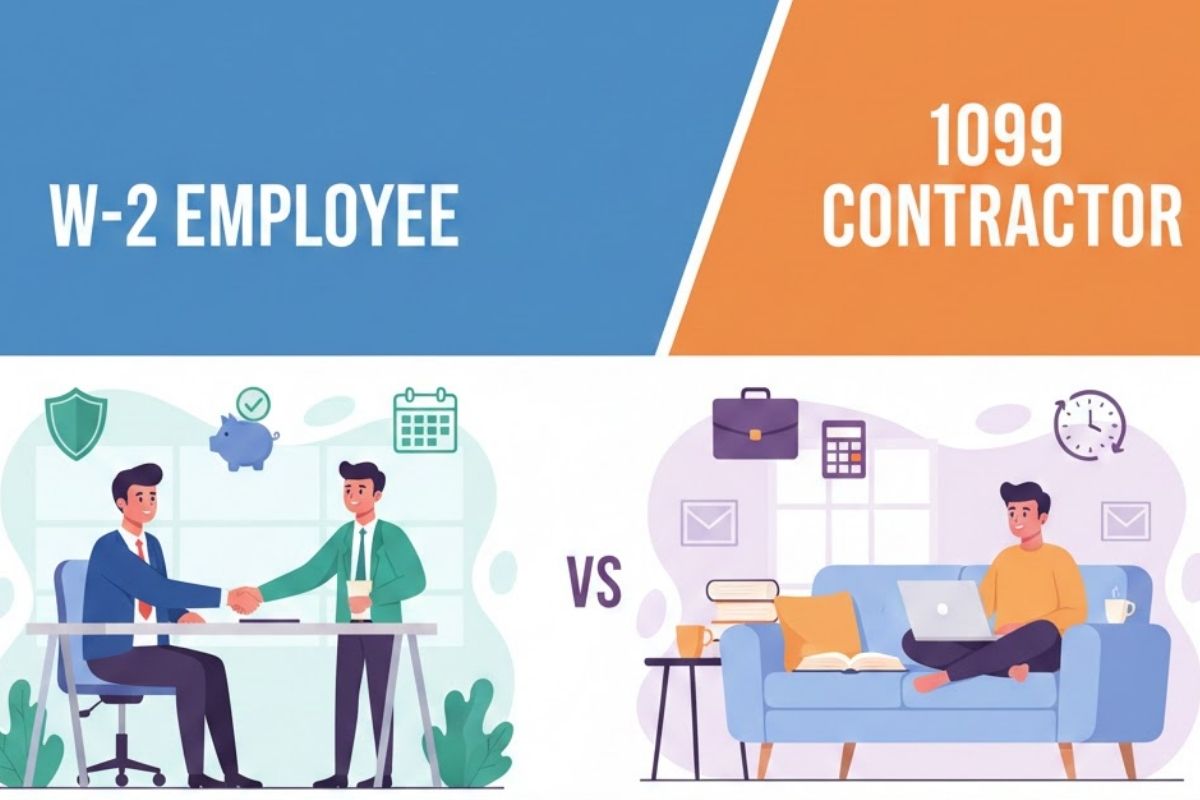

People who work, freelancers, startups, and established businesses in the US need to know the difference between a W-2 employee and a 1099 independent contractor. This classification has an effect on taxes, benefits, legal rights, the risks of not following the regulations, and long-term financial planning.

A lot of folks still don’t know what makes a W-2 different from a 1099. This wrong idea can get you in trouble with the IRS, get you sued for misclassifying personnel, or surprise tax bills.

This guide explains the genuine differences between W-2 and 1099 workers in the US today, using examples of how work is done presently.

What Is a W-2 Employee?

A W-2 employee is someone who works for a company in a normal fashion. The employer chooses when how, and when the work is done. They are also responsible for collecting taxes and providing some safety.

Every year, the employee obtains Form W-2, which includes a summary of

- Money earned

- Taxes taken out by the federal and state governments

- Paying into Medicare and Social Security

What Sets a W-2 Employee Apart

- The boss decides when and how to work.

- Taxes are taken off automatically.

- Can get advantages from work

- Rules governing work and employment keep them safe.

- Gets paid once a week

This structure is used in full-time and long-term jobs since it offers stability and legal protection.

What is an independent contractor with a 1099?

A 1099 worker, sometimes called an independent contractor, is someone who works for themselves. They don’t work for the company; instead, they provide services based on a contract or agreement.

Businesses send out Form 1099-NEC to show payments made to contractors, but they don’t take out any taxes.

Important Traits of a 1099 Contractor

In command of how work is done

- Makes their own plans

- They pay their own taxes

- Works for more than one customer

- Not able to get employee benefits

A lot of freelancers, consultants, gig workers, and specialists conduct 1099 work.

W-2 vs. 1099: Key Differences at a Glance

| Feature | W-2 Employee | 1099 Contractor |

|---|---|---|

| Tax Withholding | Employer withholds | Contractor pays own |

| Work Control | Employer | Contractor |

| Benefits | Yes | No |

| Legal Protections | Strong | Limited |

| Expense Deductions | No | Yes |

| Job Security | Higher | Lower |

Taxes: The Biggest Difference That Matters

How W-2 Employees Are Taxed

Taxes are automatically taken out of the paychecks of W-2 employees. These taxes include:

- State income tax (if it applies)

- Social Security

- Medicare

Employers also pay half of the Social Security and Medicare taxes, which makes things easier for the worker.

This makes it easier and more certain to do your taxes.

How 1099 contractors pay their taxes

1099 workers have to:

- Pay the self-employment tax, which includes both elements of Medicare and Social Security.

- Every three months, pay your estimated taxes.

- Watch your income and expenses closely.

This means doing more work, but it also lets you:

- Deductions for costs of doing business

- More control over money

- How to pay less in taxes

But if you don’t plan ahead, you could find yourself with a lot of taxes due at the end of the year.

Who gets what benefits and protections?

W-2 Workers Get These Benefits

These are the benefits that W-2 workers get:

- Insurance for health

- Time off with pay

- Plans for retirement (401k)

- Workers’ compensation

- Insurance for people who are out of work

They are also safe from:

- Laws about the minimum salary

- Rules for overtime

- Laws against discrimination

Advantages for 1099 Contractors

Clients do not give benefits to independent contractors. They need to set up their own:

- Insurance for health

- Money for retirement

- Leave with pay

They also don’t have protections like unemployment benefits or overtime pay.

Control and Independence: A Legal Perspective

The IRS focuses heavily on control when determining worker classification.

W-2 Employees:

- Follow company policies

- Use employer tools

- Receive training

- Are supervised closely

1099 Contractors:

- Choose how to complete tasks

- Use their own equipment

- Can refuse work

- Market services to others

Misclassifying workers to avoid taxes or benefits can lead to serious penalties.

Real-World Examples

Example 1: Marketing Manager (W-2)

A company hires a marketing manager who:

- Works 9–5

- Uses company software

- Attends internal meetings

- Receives paid leave

This is clearly a W-2 employee.

Example 2: Freelance Designer (1099)

A designer:

- Works with multiple clients

- Sets project-based fees

- Uses personal tools

- Decides working hours

This qualifies as a 1099 contractor.

Expense Deductions: A Major Advantage for 1099 Workers

Independent contractors can deduct:

- Home office expenses

- Software subscriptions

- Internet and phone bills

- Travel related to work

- Professional services

W-2 employees generally cannot deduct job expenses, making net income comparisons important.

Job Security and Income Stability

W-2 Employees:

- Predictable income

- Employment contracts

- Legal termination protections

1099 Contractors:

- Income varies

- Work depends on demand

- No guaranteed continuity

Some workers prefer stability, while others value flexibility and earning potential. Which Is Better: W-2 or 1099?

There is no universal answer.

W-2 Is Better If You:

- Want a steady income

- Prefer employer-handled taxes

- Need benefits

- Value job security

1099 Is Better If You:

- Want flexibility

- Earn from multiple sources

- Can manage taxes responsibly

- Prefer independence

The best choice depends on career stage, risk tolerance, and financial discipline.

Employer Responsibilities and Legal Risks

Businesses must classify workers correctly. Misclassification can result in:

- IRS fines

- Back taxes

- Wage claims

- Legal disputes

Smart companies consult:

- Tax professionals

- Labor attorneys

- Compliance guidelines

Correct classification protects both parties.

How the IRS Determines Worker Classification

The IRS evaluates three main categories:

- Behavioral Control – Who directs the work?

- Financial Control – Who bears profit or loss?

- Relationship Type – Is it ongoing or project-based?

No single factor decides — it’s the overall relationship.

Final Thoughts: Make an Informed Choice

It’s no longer optional to know the difference between a W-2 employee and a 1099 contractor in today’s flexible workforce. If you hire someone or decide how to work, the classification will affect your taxes, legal rights, income stability, and long-term financial health.

The best choices come from:

- Being aware of what you need to do

- Planning for taxes

- Following the regulations at work

- Making your work style work with your life objectives

Both W-2 and 1099 arrangements can be quite helpful and useful if you choose the proper one.

💬 Comments